Real Estate

Savannah Real Estate is land and buildings that can be owned. This type of property contributes significantly to the economy and includes things like homes and office buildings. It also covers things like vacant land, working farms, and ranches.

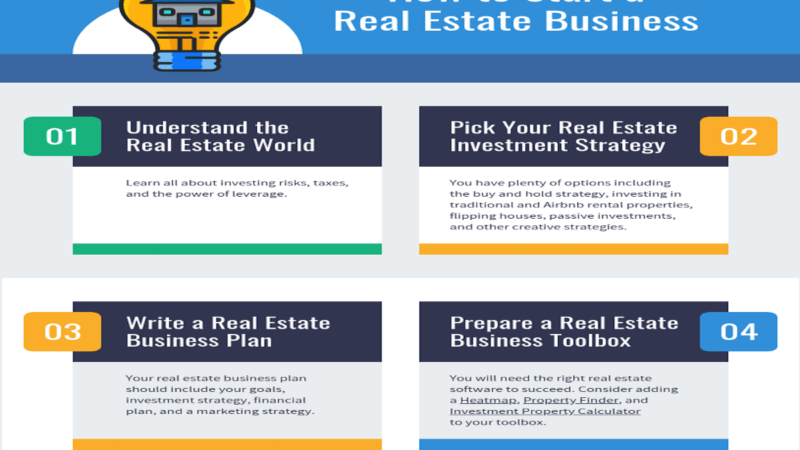

There are many ways to invest in real estate. These include homeownership, investment properties, and “flipping” homes.

Real estate refers to land and any permanent structures attached to it, including homes. It also includes any natural resources on the property such as water and minerals. It differs from personal property, which refers to anything that isn’t permanently attached to the land such as vehicles, furniture, and farm equipment.

Residential real estate is property used for private, family living purposes and includes structures like single-family homes, condominiums, townhouses, duplexes, and apartment buildings with four or more housing units. Commercial real estate is property that is used for business or work-related purposes and includes structures like offices, malls, strip malls, and industrial properties. Investment real estate is property that is purchased with the intention of making money, either through rent or capital gains.

Investing in real estate can be done directly through purchasing property or indirectly through real estate investment trusts (REITs). It’s also an important part of a well-diversified portfolio because it typically has low correlations with other significant asset classes, such as equities.

A real estate agent is a licensed professional who facilitates real estate transactions. They can help buyers find property, negotiate prices, and arrange mortgages. They can also provide information about local zoning laws and building codes. Real estate investors can also use an appraiser to determine the value of a property. If they plan to use the property for rental income, they can hire a property management company to handle maintenance and tenant relations.

Purpose

Real estate is a type of asset that includes land and any permanent man-made attachments, such as buildings, roads and fences. It also includes any rights or interests attached to the land, such as mineral deposits and oil. Unlike personal property, which can be moved from place to place, real estate is tied to the land and cannot be taken away by anyone.

Real property can be used for a variety of purposes, from providing homes for families to renting office space to businesses. The real estate industry consists of professionals who help buyers and sellers purchase, lease or sell properties. These include real estate agents, developers and mortgage brokers. The real estate market affects the economy in several ways, including by increasing or decreasing the value of land.

Investment in commercial and residential real estate is an important part of a diversified portfolio, offering a stable source of income. It can also provide a hedge against inflation, as property values typically rise at a higher rate than the cost of living. Investors can also earn money by leasing property to tenants. These types of properties include retail centers, strip malls and offices. Additionally, investors can gain tax benefits and build equity by investing in real estate. Social purpose real estate is a growing area of the real estate industry that seeks to empower marginalized communities by supporting community-operated spaces that serve their needs. This type of real estate can contribute to racial and social justice, as well as increase the financial strength of communities.

Types

Real estate encompasses land and permanent human constructions, such as homes and buildings, on it. Improvements, which are changes to land that raise or lower its value, also qualify as real property. Real estate investments often involve large sums of money that are locked in for the long term. The investment can yield steady income and can also appreciate over time.

The four main categories of real estate are residential, commercial, industrial and raw land. Residential real estate includes new and resale homes. The most common type of home is the single-family house, but there are also condominiums, co-ops, townhouses, duplexes, triple-deckers and quadplexes. The apartment building category also contains individual units within multi-story apartment buildings, such as the type found in many cities.

Commercial real estate, on the other hand, includes shopping centers and strip malls, medical and educational buildings, offices and hotels. Some apartment buildings are considered commercial, even though they are used for residences, because they are occupied and rented out to generate income.

Industrial real estate consists of land and buildings that are used for manufacturing and storing goods, such as factories and power plants. Raw land refers to vacant or undeveloped land, such as farmland and pastures. Real estate investors keep an eye on housing starts because the construction of houses and apartments can provide clues about economic trends. The types of homes built can also provide insight into the tastes and preferences of consumers.

Markets

A market is an operating mechanism where supply and demand equilibrate to determine prices. Real estate markets are a specific form of these markets, where real estate is traded as an investment. Real estate is a unique good, however, because it is often immobile – unlike other commodities like grain or oil, real property cannot be shipped from one location to another (save for mobile homes, which move to the new site). This spatial fixity necessitates that real estate markets operate according to different rules than other markets.

The real estate market operates in two main ways: user markets and capital markets. The former encompasses user-driven demand for space and identifies the needs of the end consumer. The latter identifies investor interest in space and matches capital to the appropriate real estate opportunity. Both of these markets have a profound impact on the economy and are essential to the operation of the real estate industry.

CRE professionals are constantly analyzing their local real estate market to understand the potential of their investments and the effect that changing economic conditions will have on their business. This can involve analyzing the performance of their existing assets, researching potential opportunities and assessing the financial feasibility of those opportunities using various analytical tools, including cap rates and gross rent multipliers. Emerging technologies are also reshaping the way in which CRE professionals conduct these analyses, with the rise of accessible location intelligence tools offering unprecedented capacity to understand and act on the behavior of markets and their sub-markets.

Taxes

Property taxes are levied by state and local governments to help pay for public services such as fire protection, law enforcement and road work. Property tax revenue accounts for about half of the revenue collected by local governments in the United States.

Real estate property taxes are based on the fair market value of the property at a specific time, which is determined through a number of techniques, including comparable sales and depreciated cost. The tax is then calculated as the taxable value of the property times the assessment ratio times the local property tax rate. The assessed value of the property is usually redetermined periodically, so that the tax burden is correlated with changes in market conditions.

In some jurisdictions, the taxable value of a property is directly tied to its sales, but this is not the case everywhere. For example, if tourist turnout at a popular summer festival declines over several years, local governments may be forced to increase real estate property taxes in order to meet their budgetary needs.

Financing

Financing is a vital part of the real estate investment process. The financing method used to fund a particular real estate deal can dramatically impact its outcome, which is why it’s important to understand the different types of financing available. To make the most of your investment, you must select a financing option that fits your investment goals and financial capabilities.

Some examples of real estate financing include mortgage loans and home equity lines of credit. These options are typically secured by the property, meaning that if you fail to pay your debts, your lender can take ownership of the property. This type of real estate financing is ideal for investors who want to buy and hold properties long-term.

Other methods of real estate financing include CDC/504 loans backed by the Small Business Administration. This form of real estate financing is best for small businesses that will occupy a significant portion of the property and generate substantial cash flow. Alternatively, investors can use a self-directed individual retirement account (SDIRA) to purchase real estate.

Another popular option is seller financing. This technique enables you to bypass traditional lending requirements by taking out a loan directly from the seller of the property. However, this method has some drawbacks, including higher interest rates and a limited number of potential buyers. Other options for real estate financing include hard money loans and peer-to-peer lending.